Is Your Small Business Safe From FinCEN Registration? The Shocking Truth!

Are you a small business owner in the United States? Do you feel like you're constantly battling mountains of paperwork and regulations? Then brace yourself, because the Corporate Transparency Act (CTA) and the Financial Crimes Enforcement Network (FinCEN) could be coming for you. It's a regulatory rollercoaster that leaves many entrepreneurs wondering if they need to register with FinCEN – and whether this mandate will even be enforced! Let's dive deep into this complex situation and uncover the truth!

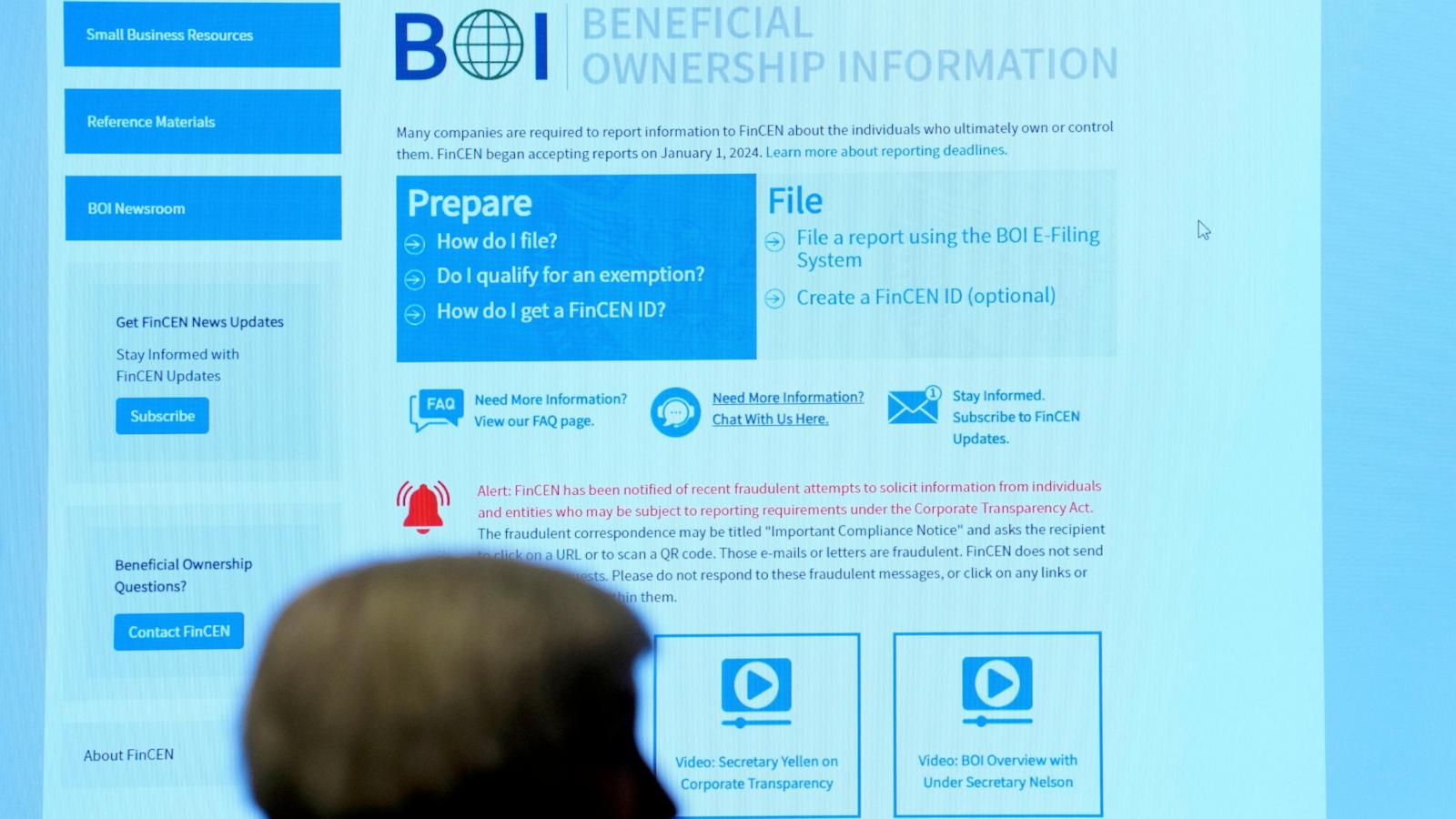

Understanding the Corporate Transparency Act (CTA) and FinCEN

The CTA is a federal law enacted in 2021 aimed at combating money laundering and other financial crimes. Think of it as a massive effort to make financial transactions more transparent. A key component of the CTA is the requirement for many businesses to register with FinCEN, providing details about their ownership. This initiative seeks to uncover the "beneficial owners" behind companies – the individuals who ultimately profit from the enterprise.

Who Needs to Register?

The CTA's mandate isn't all-encompassing. It applies primarily to corporations and other legal entities. Sole proprietorships, and many partnerships, might be excluded. This aspect has been a source of much debate and legal challenge. It's important to check your specific legal structure against CTA guidelines. Confusing, right? Many small business owners aren't entirely sure where their particular business type falls!

What Information Is Required?

If you're among those required to register, you'll need to disclose vital information about your company's ownership. FinCEN will be requesting identifying information about the true beneficiaries and the true controlling entities behind the organization. We're talking personal data like names, addresses, dates of birth, and identification documents such as passports or driver's licenses. Naturally, security and data privacy concerns have been at the forefront of the discussions surrounding this act.

Legal Challenges and the Current State of FinCEN Registration

Since the inception of the CTA, the registration process has encountered significant obstacles. Legal battles and injunctions have hampered its implementation, leaving business owners in a state of uncertainty. While initially there was a legal obligation for registration, conflicting rulings and challenges have paused the enforcement of mandatory registration.

The Latest Updates: Voluntary or Mandatory?

As of late 2023, due to legal challenges, registration remains primarily voluntary. However, this may change, leaving many in a position of "wait and see." It's crucial to remain updated on legal developments and announcements from FinCEN to know your potential obligations. Failing to comply in the future may come with steep penalties.

The Political Landscape and FinCEN Enforcement

The CTA's future remains in the political arena. Differing views on this law exist between various parties and political actors. Opposition from various interest groups continues to cause uncertainty for those covered under the law.

What Small Businesses Need To Do Now

Even though enforcement is currently paused, the legal landscape can quickly change, especially regarding a compliance requirement from FinCEN. Being unprepared could potentially lead to high fines or serious problems down the road.

Stay Informed: Monitoring the Legal Situation

This area of law is volatile, and businesses need to stay abreast of ongoing legal developments and any potential mandates regarding registration. Following industry-related publications and news alerts can keep you updated on this evolving situation.

Preparing for Potential Compliance: Gathering Necessary Information

While registration isn't mandatory for now, it is sensible to start preparing if the legal status of CTA changes in the near future. Assemble all the required information, including documentation and information about your company owners, to smoothly proceed in the unlikely case of mandatory registration requirements. Taking proactive steps now could potentially help prevent last-minute chaos.

Take Away Points

- The CTA's requirement for FinCEN registration has been and remains legally entangled.

- As of now, compliance is primarily voluntary, but this could change significantly.

- Small business owners must monitor the ongoing legal developments closely.

- Proactive preparation of essential documentation and information is wise.

- Stay informed! The situation surrounding the Corporate Transparency Act and FinCEN is dynamic. Legal updates and their implications require diligent attention from all business owners who might be affected.